ESG statement

At AXA Investment Managers, we believe in empowering our clients to invest in the transition to a more sustainable planet and society. We think asset managers can play a leading role in this transition by directing investment capital towards the businesses and projects creating solutions to some of the world’s greatest challenges, including climate change, biodiversity loss, demographic shifts, and ensuring fair and safe societies.

In our view, investing in companies and projects that are leading the way to a more resilient and equitable economy is a means to not only accelerate the transition to a more sustainable world but also make better investment decisions in terms of potential financial returns over the long-term.

There are three common pillars to our responsible investing approach incorporated across AXA IM Core fixed income, equity, and multi-asset portfolios.

- Framework for data and research: We integrate ESG in research and portfolio construction stages; seeking to generate robust quantitative data that can guide portfolio managers, while delivering qualitative research that digs into how ESG themes are affecting assets, sectors and regions.

- Exclusions: We apply both firm-wide minimum sectorial policies and AXA IM Standards which exclude non ESG-compliant exposures.

- Active ownership: We are proactive with our engagement and voting to identify potential ESG risks before they materialise.

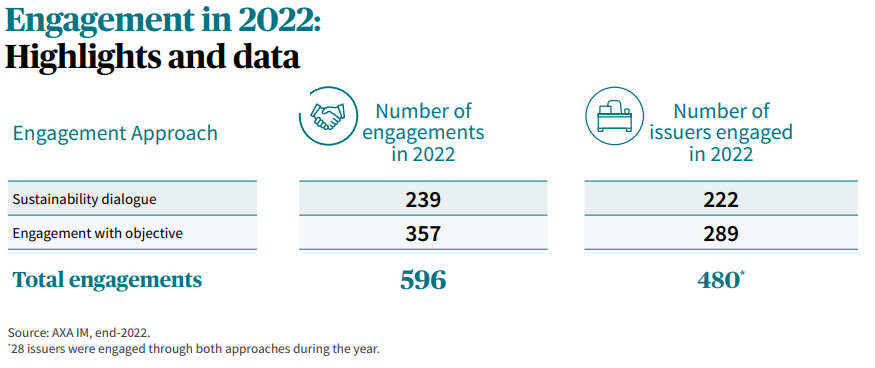

Stewardship is one of the top priorities on our responsible investing (RI) roadmap.

We continue to engage with companies, issuers, and policymakers on sustainable finance matters.

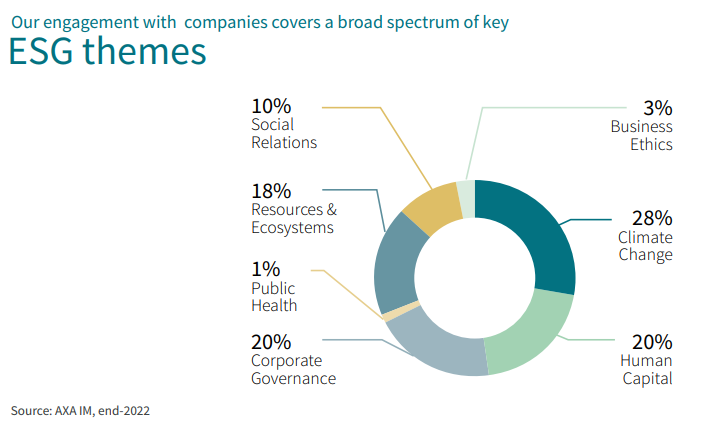

Climate, biodiversity and social issues are the key priorities for our engagement, along with corporate governance, forming a key dimension of our RI strategy.

Disclaimer

In Singapore, this Communication is issued by AXA Investment Managers Asia (Singapore) Ltd. (Registration No. 199001714W). In Hong Kong, this Communication is issued by AXA Investment Managers Asia Ltd, an entity licensed by the Securities and Futures Commission (“SFC”).

It is for information purposes only and does not constitute an offer to buy or sell any investments, products or services and should not be considered as a solicitation or as investment advice. This Communication may be subject to change without notice. Please consult your financial or other professional advisers if you are unsure about the information contained herein. Investment involves risks. Be aware that investments may increase or decrease in value and that past performance is no guarantee of future returns, you may not get back the amount originally invested. You should not make any investment decision based on this Communication alone. This Communication and the above mentioned websites have not been reviewed by the Monetary Authority of Singapore or SFC.

© 2023 AXA Investment Managers. All rights reserved.