The second webinar in the ESG Pathway series was another fantastic session of engaging debate and analysis of where we currently stand in the investment industry in terms of responsible investing.

The ESG Pathway webinar series is a joint initiative from Square Mile Investment Consulting & Research and ESG Clarity with the aim of educating and expanding the dialogue between advisers and members of the responsible investment community.

During the second session on 14 October, we had another insightful adviser panel hosted by Square Mile’s Jake Moeller, which saw panellists Darren Lloyd Thomas, managing director at Thomas & Thomas Ethical Investments, Andrew Watt owner and director of Watt Money, and James Lawson, Tribe Impact Capital kick off the webinar with how they begun and where they are on their various ethical journeys.

They discussed how conversations with clients has evolved as they incorporate more questions around values and responsible investing.

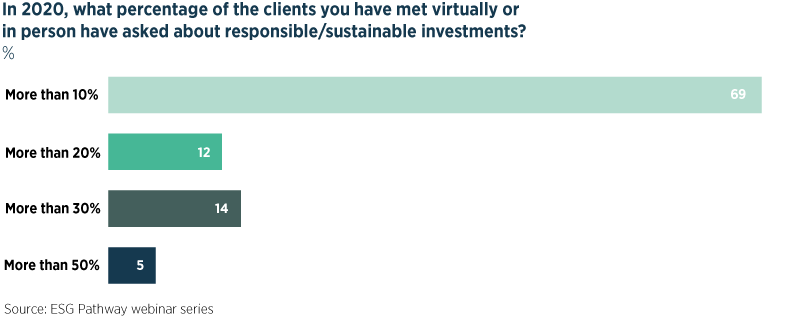

Polls carried out during the live ESG Pathway event showed that 70% of listeners had 10% of clients asking about responsible investing, while 12% of advisers said more than 20% were enquiring, and 14% said more than 30% of their clients had put in requests for further information.

Poll Results

The advisers also explored the huge range of products asset managers have brought to the market and areas where there might be room for more vehicles, but also emphasised there is already plenty of choice to choose from across asset classes.

See the full story: – ESG Pathway: Conversations with clients and how to avoid greenwashing

In our Ask the Expert panel, 7IM’s head of investment strategy Terence Moll responded to queries on ESG fund selection, Schroders’ head of sustainability strategy Hannah Simons explained that responsible investing is not just a short-term trend in the wake of the pandemic, and JP Morgan Asset Management’s global market strategist Vincent Juvyns shared thoughts on why the crisis has created more opportunities for responsible investing.

We were also delighted to be joined by Jenny Davidson, head of platform solutions from Standard Life, to give us the platform view and she explained how she expects platforms to play a more significant role in the ESG landscape particularly in this digital age.

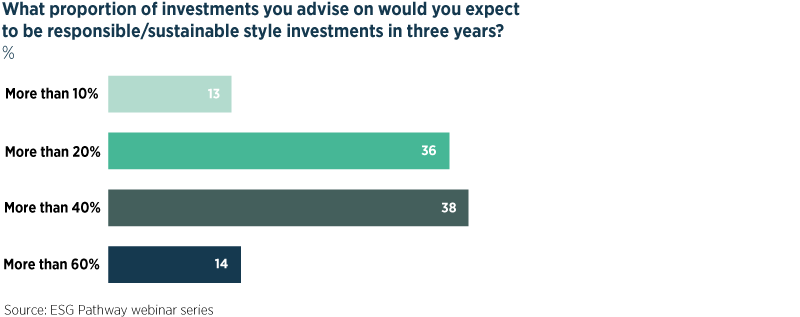

Poll Results

In the asset manager panel, chaired by Square Mile’s Richard Romer-Lee, Aberdeen Standard Investments’ global head of stewardship & ESG investment Euan Stirling, Invesco’s global head of ESG Cathrine de Coninck-Lopez and Janus Henderson analyst for governance and responsible investment Charlotte Nisbet discussed how companies are behaving in the wake of Covid-19, but how the pandemic has significantly ramped up interest in ESG investing.

The trio agreed the pandemic had accelerated a of lot of ESG trends that were already in play before the coronavirus unfolded, such as increased engagement, social impact and how companies are looking after supply chains and employee mental health.

Stirling highlighted Covid-19 had “forced generational change in the blink of an eye”.

The overriding message from the asset manager panel was that how we work and live is changing, and therefore investment patterns will change to.

A replay of the event can be found here.

The next ESG Pathway webinar will be held on 4th November at 10am where we will be exploring what sustainable investing really means and look at how asset managers are evidencing that.

To view the full agenda and register, click here.