Advisers discussed the evolution of client conversations when it comes to responsible investing, and how to avoid ‘greenwashed’ funds in the latest ESG Pathway webinar series.

On 14 October, ESG Clarity held the second ESG Pathway episode in conjunction with Square Mile Investment & Research Consulting, with an adviser panel, asset manager panel, platform speaker and opportunity to ask the experts burning questions.

The adviser panel, hosted by Square Mile’s Jake Moeller, saw panellists Darren Lloyd Thomas, managing director at Thomas & Thomas Ethical Investments, Andrew Watt, owner and director of Watt Money, and James Lawson, co-founder and partner at Tribe Impact Capital, discuss how they have introduced responsible investing to clients and the challenges along the way.

See also: – ESG Pathway: Tips for IFA firms starting ESG journey

Conversations

Overall, the adviser trio said their conversations have adjusted with clients with this being influenced by both sides; the IFAs are exploring a client’s values in more depth than before and asking how they would like to align these with investments, and the clients are coming to them with more questions around sustainable investing.

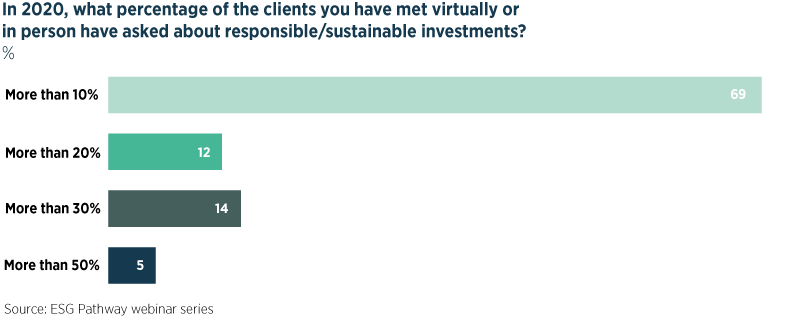

Polls carried out during the live ESG Pathway event showed that 70% of listeners had 10% of clients asking about responsible investing, while 12% of advisers said more than 20% were enquiring, and 14% said more than 30% of their clients had put in requests for further information.

Poll Results

Lloyd Thomas shared with the panel that previously his initial discussions with a client would be concentrated on financial planning and risk, before mentioning ethical investing at the end, but he has since moved away from that.

“We talked about profitability and numbers, but we had to change,” he said.

There has been a slow shift in this direction across the industry but more needs to be done ahead of the incoming MiFID II changes, which require ESG to be part of suitability processes in 2021.

Tribe’s Lawson pointed out: “IFAs have to have in-depth convos with clients on what their values are.

“Conversations mostly start with ‘what do you want to avoid – tobacco?’ ‘Why?’ ‘It’s harmful’.

“We then need to educate the clients on the solutions to that. There are healthcare cancer treatment companies

“We need to see a pivot away from ‘what do you want to avoid?’ to focus on the solutions,” he added, echoing the sentiment from a recent comment piece from the Investment Association’s Jess Foulds that said “divestment should be a last resort, not a first response”.

See also: – ESG Pathway: Key takeaways from the first webinar

Poll Results

Watts hammered home the point of having in-depth discussions with clients to truly understand what they are trying to achieve with their investment portfolios, but to also educate them on what they can achieve.

“The best bit is talking to clients. People recycle, and they might have an electric car or worry about the ice caps but have not realised what they can do with their money.

“I love educating clients on that and have people walking out of the office smiling when they realise how they can make a difference with their investments.”

Clients who truly understand their portfolios and the impact they are making, also tend to perform better, added Lawson.

He said: “I don’t know any sector anywhere in the world where clients bored and unengaged leads to better outcomes. The more engaged and interested in the portfolio the client is, the better the outcome is.”

Greenwashing risk

The panel also discussed the plethora of products that have joined the market, particularly this year. Morningstar recently reported there were 2,706 sustainable funds in existence for European investors at the end of Q2, with 107 new products coming to the market in that quarter along.

Thomas said when his firm launched a range of ethical risk-rated portfolios, there were fewer than in the mainstream range.

“We have five risk-rated portfolios in the mainstream range but when we launched the ethical range, we had to take out portfolio 1 (cautious) and 5 (adventurous).

“We had to ask ourselves whether we can deliver a portfolio with a truly cautious aspect, and also can we be confident in emerging markets and Asia and where they are with ESG that we would be delivering what we promised to clients.”

However, Watts and Lawson commented they are finding plenty of products to cater for all kinds of clients.

Watts said: “We need to get over this point that ESG cannot be catered for in all asset classes – every asset class can be catered for.”

He added the “big players” in the fund industry are launching products all the time in new areas.

Lawson noted that while there are less options to choose from in emerging markets or region-specific funds, he feels there is still plenty of choice. He added: “If we were trying to do this 30-40 years ago, it would be hard, but it is absolutely possible now. Investors can do very well in a sustainable mandate across the risk spectrum.”

However, with so much choice comes the need for further research and scrutiny in order to avoid ‘greenwashing’.

Lawson commented: “There is this huge pressure on every asset manager to have a sustainable offering.

“The flow into ESG funds between April and August was bigger than the previous five years, and clearly there are a lot of people jumping on bandwagon.

“This means we must scrutinise everything.”

Lloyd Thomas went as far as predicting a “green mis-selling scandal” in the future as there are so many funds using sustainable or ESG labels that are clear on their ESG criteria. Therefore, the panel all agreed, educating clients on the many variations between funds is of serious importance.

“There are many funds masquerading as ESG but if you really look underneath, they are not really what the client thinks they are getting,” Lloyd Thomas said.

“My biggest nightmare is when clients start to peel back portfolios put in front of them and ask why there are oil and tobacco stocks featured.

“IFAs need to explain to clients that these portfolios can have oil companies that are behaving responsibly and companies treating staff well, for example.

“There is a real danger that the public are going to slip through cracks and end up with an investment that they do not understand or realise what they are investing in.”

Fellow panellist Watt said he “keeps banging on about education”, but highlighted it is paramount to avoid situations outlined by Thomas.

“We urge advisers to engage with those around you. There is a massive opportunity to educate especially in lockdown as we can talk about what is happening, lower carbon due to less travel, for example. This is an opportune time to talk to people about making more of a difference.

He also called on advisers to be mindful of diverging away from normal fund selection processes as they get caught up in the deluge of ESG products on the market.

“There are a lot of big players in the market throwing vast resources at talking to advisers about what they have available. There is a lot out there, IFAs need to be mindful of staying loyal to their process and reviewing their funds every year.”

The next ESG Pathway webinar will be held on 4th November at 10am where we will be exploring what sustainable investing really means and look at how asset managers are evidencing that.

To view the full agenda and register, click here.