Mining may be the last industry many investors think of when considering ESG issues and the changing dynamics they bring to an investment decision. However, there’s a quiet revolution underway that is delivering more change than has been seen in centuries.

Despite the common negative view that mining is a ‘dirty industry’ due to a troubled past, many investors are unaware of the transformation the industry is undergoing in its efforts to clean up its reputation. This comes at a time when the world is more resource intensive than ever before, and the industry is ripe for investment and opportunity as it’s becoming safer, more efficient and more sustainable. In recent times, the industry has been making silent, but significant leaps, due to a change in management culture, embracing new technology for increased efficiency and ultimately, investor demand.

Mining continues to innovate at a rapid pace in each area of ESG with technology at the crux of these efforts. Advances are being seen in areas such as the use of artificial intelligence in mine planning (reducing mine footprints), driverless trucks and trains that limit emissions, improved safety practices and increased use of renewable power sources, to name a few.

Innovation in the mining industry

The mining industry recognised years ago that changing stakeholders’ perceptions about its environmental impact would require a substantial shift in operating methods embodied in the wide embrace of technology. Mines are now being designed to substantially minimise their impact. It is no longer acceptable for mining companies to find and extract materials without serious environmental, and regulatory, considerations. Technological progress in mining is moving at a rapid pace, working to create operational efficiencies that leave a much smaller footprint than before, using artificial intelligence and automation.

This transformation is still in early stages, but the mine of the future will be a blend of technology and best practices from other industries, shifting thinking from the mine in its traditional sense to one that is part of a larger industrial process.

In addition, there are plans of building renewable power stations at mine sites to supply the operations and the local community with affordable, clean power, a monumental move for any extraction business, creating immediate socio-economic benefits. For example, in Chile, there are trials of solar farms floating on copper mine tailings ponds, which reduces evaporation whilst also generating clean power from an area that would normally go unused.

Another knock-on effect is that access to finance is becoming broader: renewable energy projects allow the mining company to access capital through ‘green’ bonds, improving their social scores with bond agencies. The green bond market is growing fast, with a large share of projects relating to energy and water.

Social transformation

Mining has had a historical dark side, including child slavery practices, forcing the industry to make robust change. The industry has since taken the initiative to eradicate modern slavery, human rights abuse and child labour altogether.

The most monumental development is the introduction of the ‘social license to operate’, which each mining firm must obtain before extracting. This is a contract between the host nation and the company, outlining the responsibilities of the firm to maintain good practices or risk losing the right to extract in that nation. In addition, mining firms are increasingly hiring indigenous workforces to support local initiatives and boost individual economies.

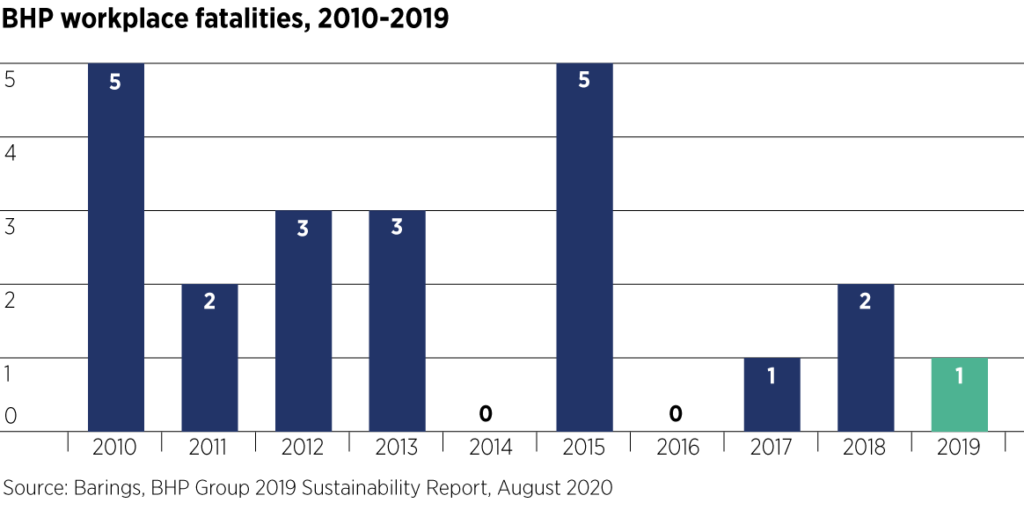

The next big change in societal reform has been the increased efforts in terms of safety. Once a largely dangerous profession, firms now have been on a quest for zero harm in the workforce. Accountability in these efforts has taken centre stage as well. In 2019, BHP’s then-CEO’s annual bonus reduced by 25% in part due to a single fatality in one of the company’s coal mines,showing how seriously the industry takes this.

Increased governance efforts

From an investors’ perspective, governance can be the hardest of the three ESG elements to define. Corporate governance in the mining industry includes treating all minorities fairly, aligning executive compensation with all stakeholders including workers and local communities, and creating strong policies and processes to combat corrupt practices. It also involves such areas as minimising tax avoidance schemes and robust cyber security.

Investment potential

As this quiet revolution in mining gathers pace, investors are well served to watch closely, identify the early leaders and assess where returns will emerge that are better and more sustainable. Elements of this ancient industry are set to become leaders in technological, operational and social change that will set standards for mining firms – and all firms – to follow for years to come.