In the wake of a company-wide restructuring, Envestnet has added a leadership position that will focus entirely on the company’s own footprint across ESG standards.

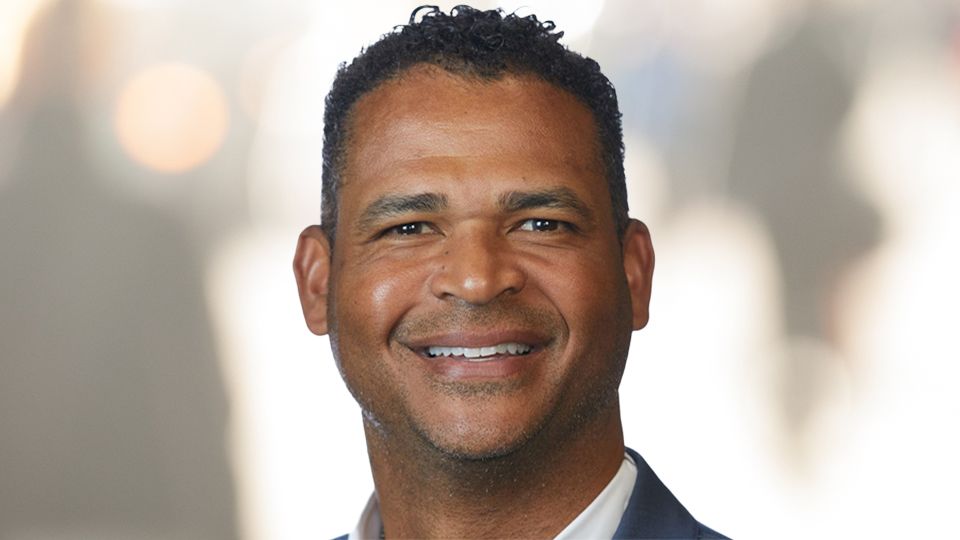

The provider of outsourced investment management and financial technology appointed Ron Ransom as group head of ESG, a new role within Envestnet. Ransom will report to Dawn Newsome, Envestnet’s chief business operations officer.

Ransom most recently served as chief business development officer at Envestnet, where he managed the company’s go-to-market strategy. Prior to that, he held leadership positions at Nationwide Financial, UBS and Bank of America.

“There has never been a more important time to strengthen our focus on ESG throughout our organization and make this area a central part of our financial wellness ecosystem,” Envestnet CEO Bill Crager said in a statement. “By formalizing our company-wide ESG efforts under Ron’s leadership, we can find ways to make an even greater impact on behalf of our industry, shareholders, customers and employees, as well as individuals and families in the communities where we live and work.”

In his new role, Ransom will partner with divisions throughout the company, including the sustainable investing group, which helps financial advisers integrate ESG into client portfolios, and work to build strong relationships in the various communities in which Envestnet maintains offices.

InvestmentNews spoke with Ransom about the new role, the initiatives he hopes to enact and why companies should focus on their ESG footprint.

The following has been lightly edited for length and clarity.

What can you tell us about this newly created role at Envestnet and what you’ll be doing?

It’s an honor for me to be able to take the leadership role here for our efforts to fold together a lot of great work that has been taking place throughout Envestnet. Our current ESG efforts have been strong in many different pockets. We just feel that there is no better time than the present to pull it all together. Most all companies, at least the well-run companies, are paying more and more attention to this space. Our efforts going forward will be how can we make a footprint in ESG for our customers, for the industry and for our employees.

Is this more about improving Envestnet’s own ESG impact as a company rather than providing ESG investments to financial advisers that work with Envestnet?

My focus will be much more around the corporate ESG efforts as a company. We do have sustainable investments, which takes place within our [portfolio consulting group] and I’ll be partnering with them. This is more around the corporate ESG footprint for Envestnet.

What sort of initiatives are you looking to introduce?

This is a marathon effort. This isn’t a sprint. A lot of where we are today is a strong governance perspective. I want to make sure that we are able to articulate for investors, our shareholders and again for our own employees where we are, what our vision is from an environmental perspective and from a social perspective. I think there will be an emphasis on the E and the S out of the gate. Not that we are going to ignore the G but I think we currently have a leg up on the G. It’s really that our stance is to continue to have a strong and even stronger footprint in both the environmental and social space.

How will your previous experience in the industry inform how you approach going forward at Envestnet?

I’m rapidly approaching three decades in the industry. I’d like to think I’ve learned a thing or two. Honestly, what I love most about the business is it continues to grow, continues to evolve, it’s an honorable profession. And I think what you’re seeing in the industry in the space of ESG is just ways that Envestnet can continue to help individuals and institutions alike to achieve financial stability or, as we refer to it, the intelligent financial life, or financial wellness. I love to be a student of the business. I’ve been in leadership for 20 of the last 30 years that I’ve been in the business. What I can do to lead our corporate efforts to continue to get better in this space is just something I’m honored to take on.

Why is it important for a company like Envestnet to have someone dedicated on ESG?

Across the globe, corporations make a difference as employers and as members of the community. ESG is no longer a nice to have, it’s a need to have. You have to actually pay attention. It’s not something you can have as an afterthought. It’s something that needs to be a priority in an organization, and we want to be very purposeful about our ESG efforts.

What are biggest challenges facing the ESG space right now?

The natural challenge is the fact that it’s always evolving and always changing. You have to stay focused, you have to stay vigilant and you have to stay consistent. It’s a big topic, ESG, and you can’t be great at all of them. To really have an area of focus on your ESG footprint and what you can impact and really do as well as you can and partner as well as you can is really important.

InvestmentNews has written recently about how ESG has become a political issue, with some states proposing a ban on ESG while regulators are examining so-called “greenwashing.” How will you approach some of these issues with your role at Envestnet?

I think a lot of that is more specific to the sustainable investing side of things versus the corporate footprint. For us and where I anticipate us going is how do we just continue to do the right thing. And that’s part of what brought me to Envestnet. A big part of who we are as an organization shadows the leader. I think Bill Crager has really laid the groundwork on really doing the right thing, not some of the time but all of the time. And that’s where we’re going to continue to be focused and continue to be grounded.

This interview first appeared on Investmentnews.