Invest in our planet is the theme for Earth Day 2023. Decarbonising our energy system is an essential part of protecting the environment, moving away from polluting fossil fuels and towards renewables to mitigate the impacts of climate change. Here, we consider the crucial role of the financial sector in the energy transition.

Banks making positive commitments…but action is lagging behind

There’s been positive steps towards investing in a cleaner energy system, with the launch of the Net Zero Banking Alliance (NZBA) in April 2021. NZBA is part of the broader Glasgow Financial Alliance for Net Zero group (GFANZ), which also includes asset owners, insurers, asset managers and other key financial service providers.

Over 40% of banks (by assets) are signed up to NZBA globally, committing to align their lending and investment portfolios with net zero emissions by 2050. They are also required to set public intermediate targets for reducing their emissions by 2030 and must publish the carbon emissions across their lending portfolios and investment activities annually.

However, in the short term, banks are continuing to provide significant fossil fuels financing. Since joining the NZBA, 56 of the biggest banks in have provided $270bn to 102 major fossil fuel expanders. For example, Citigroup has facilitated $30bn funding to fossil fuel developers including Saudi Aramco, QatarEnergy and Gazprom since joining NZBA.

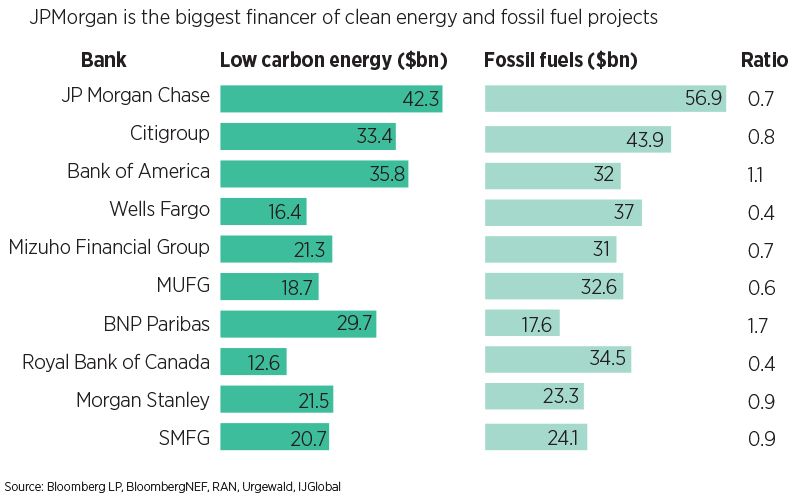

Research also shows that banks are significantly lagging in their investments in clean energy. We’ll need at least four times the rate of fossil fuel investment by 2030 to limit global warming to 1.5 degrees. But BloombergNEF has calculated that, on average, members of NZBA provided 8% less financing for renewable energy than for fossil fuels during 2021 across loans, bonds, equity and project finance. The current ratio of 0.92 to 1 is well short of the 4 to 1 ratio required.

As the chart below shows, Wells Fargo and RBC had particularly poor financing of renewables – only $40 of financing for every $100 they provided for fossil fuels. The standout bank was Natwest (not included in the table), which provided 5.5x as much financing for renewables as fossil fuels.

Top banks by energy financing volume in 2021

As well as the obvious implications for the planet, fossil fuel financing is putting banks at increasing risk of litigation. BNP Paribas is facing legal action for its fossil fuel financing, which is the world first climate lawsuit against a bank. It seems reasonable to expect there may be further climate cases against banks, following several high-profile legal cases against energy companies over recent years.

Ethical fund managers

Recognising the vital role of the financial sector to support the net-zero transition, we’ve been asking a specific question on this in our ethical fund due diligence process since 2021. Fund managers need to tell us whether their fund has a policy that calls for a reduction of fossil fuel exposure through banks, insurance companies, and other financials (financed emissions).

Our findings show that our ethical fund managers take three broad approaches:

- In our more strictly screened portfolios, some managers avoid investment banks entirely, focusing their exposure on retail banks and building societies whose main business is providing loans and mortgages, and with minimal exposure to fossil fuels. This is the strictest approach, but it results in reduced portfolio diversification since most banks are excluded from their portfolio.

- Other managers look to avoid the banks with the highest exposure to fossil fuels, tilting towards banks with a greater share of green lending. This removes some banks from the portfolio but is a more balanced approach than strict screening.

- Managers with a more positive approach may invest broadly across financials but want to see banks setting credible net-zero targets, disclosing more detail on the environmental credentials of their loan and mortgage books, committing to scale up green financing and stop funding new fossil fuels projects, and link these targets to executive compensation.

Regardless of their approach, we expect the fund managers in our active ethical solution to have a policy on fossil fuel financing and to be taking steps to reduce exposure to financed emissions in their portfolios. We also expect them to be encouraging financial companies to reduce exposure to fossil fuels and report on their progress. Fossil fuels financing will remain under the spotlight and we will keep a watching eye on developments in this space.