On World Ocean Day investors have an important opportunity to review the positive impact they can have on biodiversity and the environment via their savings.

Both World Ocean Day and the recently celebrated World Environment Day have been established by the United Nations to raise awareness of the major environmental challenges that we face to restore the health of our planet. These include prominent issues such as climate change and plastic pollution, which are threatening life on land and in our oceans.

For example, the UN estimates that climate change and unsustainable fishing have already resulted in the depletion of 90% of big fish populations and the destruction of 50% of coral reefs.

The good news from an investment perspective is we now have positive choices we can make with our savings to encourage the greening of our cities and energy sources; to support companies that are promoting a more circular economy and are cleaning up the plastic pollution in our rivers and oceans; and to invest in a more sustainable future for all.

Below are three funds we hold in the Tilney Sustainable MPS that play the sustainability theme:

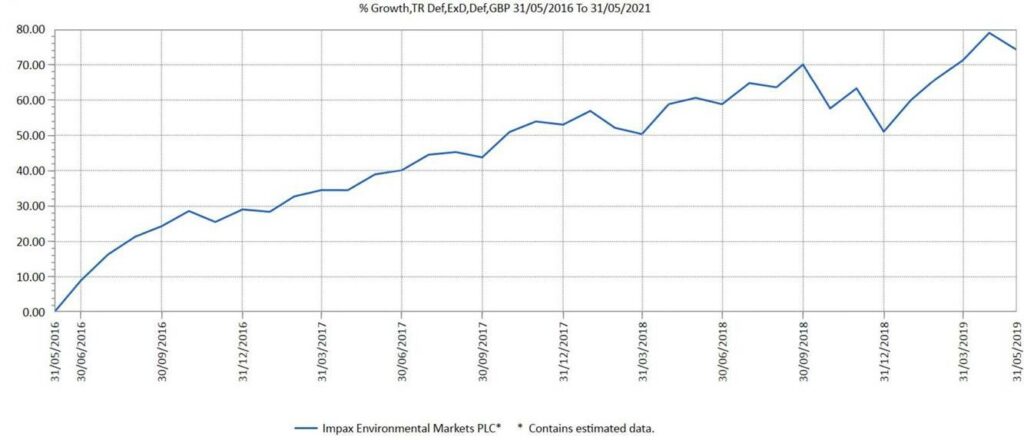

Impax Environmental Markets

The trust invests globally in companies that provide environmental solutions through their products or services. The trust’s objective is to enable investors to benefit from growth in the markets for cleaner or more efficient delivery of basic services of energy, water and waste. The main investment themes of the portfolio are clean energy and energy efficiency, water treatment and pollution control, waste technology and natural resource management and sustainable food, agriculture and forestry. Impax has a strong performance track record and are well-respected specialists in this area of the market.

It also reports the positive impacts of their investments in the annual report, which include net CO2 emissions avoided, renewable energy generated and the treatment for waste and water.

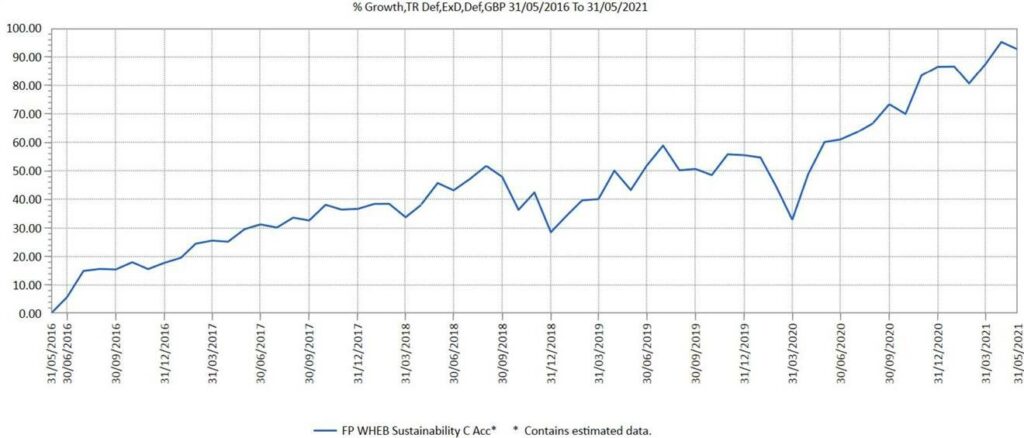

WHEB Sustainability

WHEB is a specialist investor that seeks to have a positive impact on the environment and society. The objective of the fund is long-term capital growth via a portfolio of global companies, which have strong growth prospects linked to key sustainability growth themes.

The nine themes WHEB seek broad exposure to are environmental services, resource efficiency, water management, sustainable transport, cleaner energy, safety, health, wellbeing, and education. Investors in WHEB are able to access their online Impact Calculator, which illustrates the underlying positive impact that companies in WHEB’s investment portfolio help create.

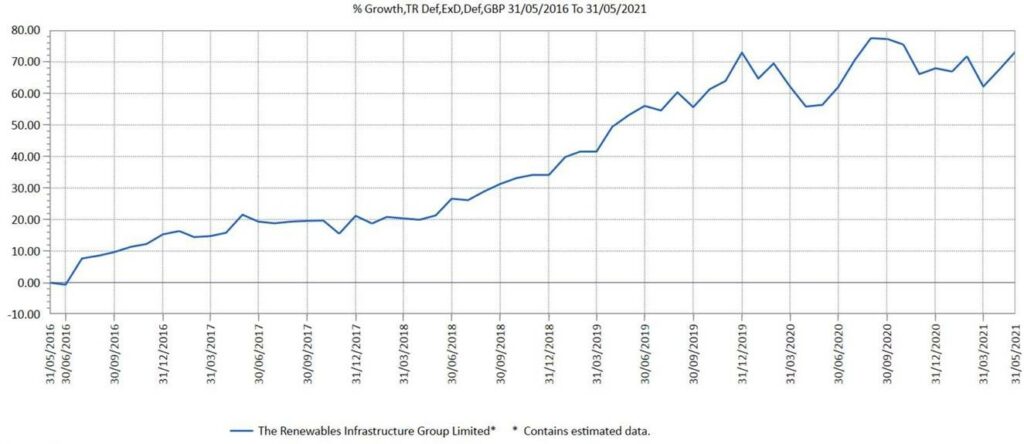

The Renewables Infrastructure Group (TRIG)

TRIG is a London-listed (FTSE 250) investment company that has more than 75 renewable infrastructure projects in the UK, Ireland, France, Sweden and Germany. TRIG aims to deliver a sustainable yield on a diversified portfolio of predominately wind and solar assets across a number of distinct geographies. It provides shareholders with diversification by jurisdiction, power market, energy source and weather system. TRIG contributes to a zero-carbon future with a portfolio capable of saving more than 1.2m tonnes of CO2 emissions annually by powering over 1.1m homes. This investment is aligned to UN SDGs 7, 11, 13 and 15.