Although overall prospects for the impact bond market are brighter in 2023, we see early signs of a ‘two-tier’ market beginning to emerge, with growing competition for high-quality instruments at one end of the market and a widening pool of impact bonds with weaker profiles at the other.

The market has since early years been characterised by an undersupply of investable impact bonds versus demand and research by the ECB has pointed to a greenium for ‘credible’ issuers or frameworks’.

Meanwhile regulatory developments such as the EU Green Bond Standard and China’s revised Green Bond Principles increasingly set a higher bar in terms of disclosure, verification and ongoing reporting, which will likely reinforce the emergence of this two-tier market.

These factors are likely to drive demand even for bonds with weaker ESG credentials or frameworks.

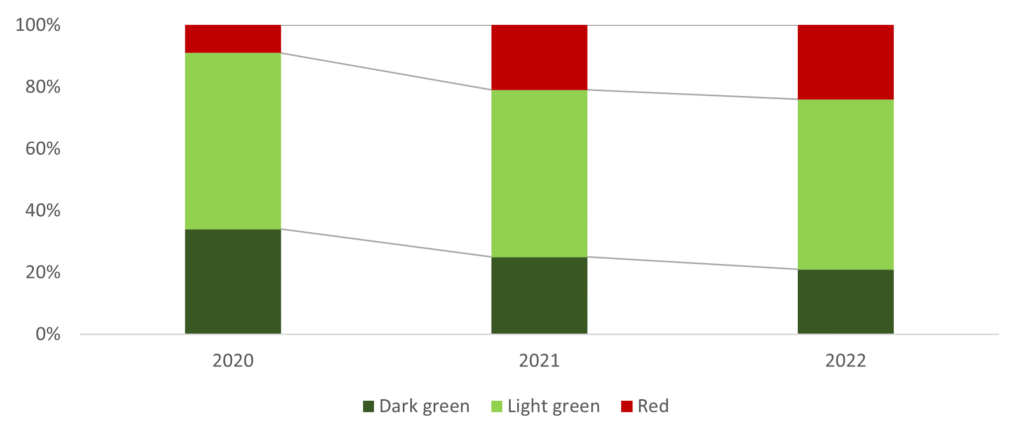

Insight’s in-house assessment of impact bonds shows the share of such instruments receiving a ‘dark green’ best-in-class rating has fallen in recent years, alongside an increase in ‘red’ ratings and a sharp increase in the variety of issuers bringing such instruments to market in recent years, across diverse sectors, geographies and sizes. Some sectors, such as real estate and property, have shown persistently higher share of ‘red’ ratings owing to weaknesses in frameworks and reporting.

Increase in bonds with ‘red’ ratings

Although this should not be considered a representative sample of the market, it reinforces our perception that a two-tier impact bond market may be starting to emerge. Costs of issuance in line with standards such as the ICMA Green Bond Principles, reporting and external verification have risen sharply in recent years, and are likely to rise further as a result of regulatory tightening, which may be a consideration for newer entrants to the market. For investors, this means that ongoing impact reporting of sustainability outcomes (eg. at the fund level) is rising in importance.

The sustainability-linked bond (SLB) market saw a significant decline in issuance in 2022 and faces growing credibility issues in the eyes of investors and regulators, particularly among financial institutions, where their variable coupon structure is at odds with regulatory capital requirements in many jurisdictions. This scrutiny is likely to increase despite the greater flexibility SLBs offer issuers with business profiles less suited to use of proceeds structures. Over 2023, we expect to see greater standardisation in the SLB market (and potentially more robust target-setting) to address these concerns.

Elsewhere, emerging markets are likely to be key beneficiaries of market stabilisation, standardisation and renewed growth of the impact bond market, owing to the range of environmental and social investment needs in such markets, and key sovereign issuers such as India are expected to issue green bonds in 2023 – although rising costs of external verification and best practice reporting could pose difficult trade-offs for impact-focused investors. Emerging market corporate bonds yields are currently at their highest level for about a decade, and are becoming more attractive to investors. Emerging market green bonds have offered a structural yield premium over developed market equivalents since 2019, when the emerging market green bond market really began to achieve scale.