The UK investment industry faces great upheaval over the coming years if proposals under the Financial Conduct Authority’s Sustainability Disclosure Requirements (SDR) are given the final green light, according to the director of responsible investing at Coutts Karen Ermel.

However, the hard work will be worth it in terms of ensuring investors understand the ESG products they are investing in, improving trust in the industry and ensuring capital flows are directed towards solutions having a climate and social impact.

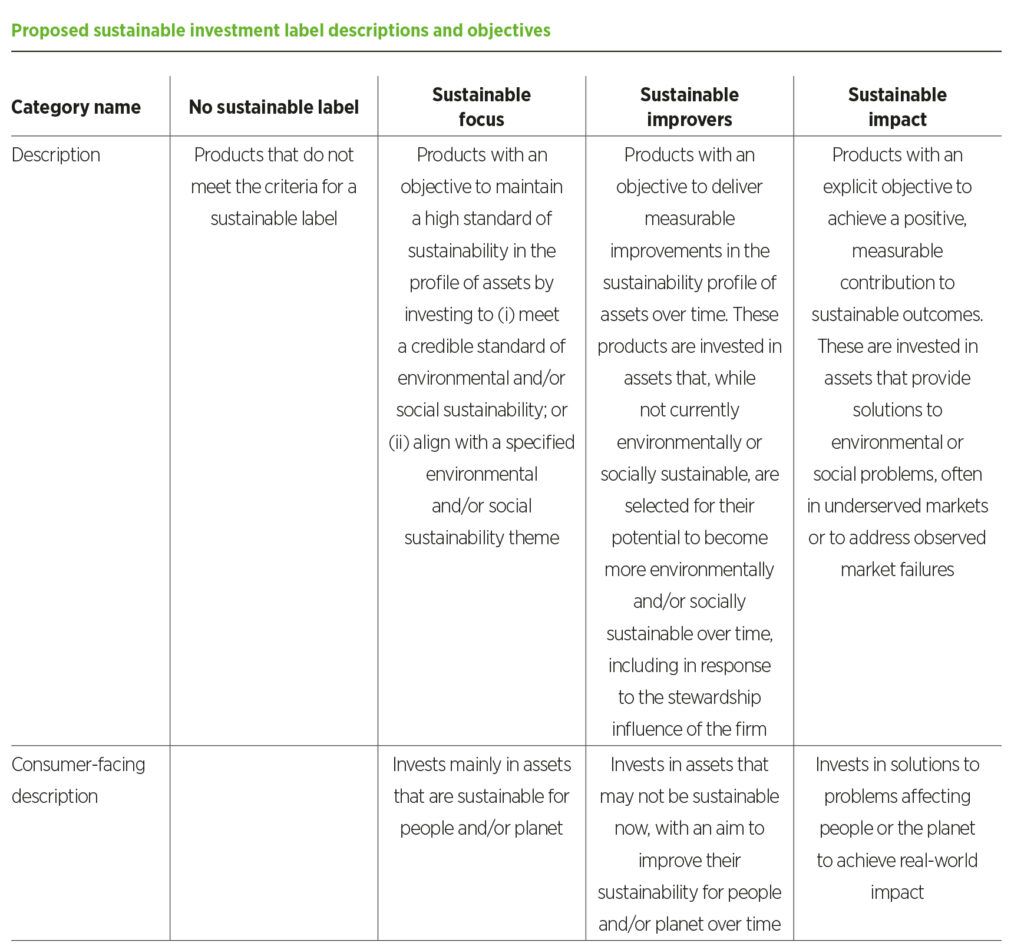

Last week, the regulator announced its long-awaited proposals on fund labels – with the new buckets being called ‘focus’, ‘improvers’ and ‘impact’ – and disclosure requirements at two levels – one for consumers that outline the product’s key sustainability-related features, and more detailed disclosures for institutional investors.

It also announced from June 2023 all regulated firms must name and market their products in a way that is “clear, fair and not misleading, and consistent with the sustainability profile of their product or service” even if they don’t apply for a sustainability fund label.

“We are very pleased to see [SDR] finally come out and see this level of ambition on disclosure requirements,” said Ermel in an interview with ESG Clarity EU. “It shows the FCA has used the time to do intensive research, actually consulted and listened, and the proposals show an understanding of how the investment processes work.

“It is what retail investors need and is what the industry has been calling for for some time – there has been so little clarity around ESG so far and mistrust from consumers when they see ESG.”

See also: – SDR: Is this the ‘watershed’ moment for ESG in 2022?

She added firms need to prepare to carry out “a lot of work” to comply with the requirements, particularly in areas such as stewardship and measuring impact.

“Not many funds will fit into those three labels naturally, and if you want products to do so it means changing investment objectives by applying to the FCA,” Ermel said.

“Groups will also need to demonstrate how their stewardship is adding value. That may well be happening already, but it is not always aggregated and at a large scale.

“The regulation has also talked about measuring impact and is really focused on additionality. So companies will need to measure impact not just through the companies they invest in, but will need to show the difference they are making with their asset allocation, portfolio construction and stewardship.”

Despite the significant amount of work to align the industry with the new requirements, Ermel said this shouldn’t be perceived as a negative as a “thorough” approach to sustainability is needed across the industry.

SFDR links

While it seemed like the FCA would align with the EU’s Sustainable Finance Disclosure Requirements (SFDR) when it began consulting, the latest proposals are a clear step away from that, which is a “good decision”, according to Coutts’ Ermel.

“In Europe, it has turned into a bit of a hierarchy with Article 9 being the best. The FCA has instead gone for three different labels with clear objectives – an ‘improver’ fund is completely different to an ‘impact’ fund.”

She also highlighted SDR’s category description for ‘impact’ strategies says products “would pursue its sustainability goals by directing typically new capital to projects and activities that offer solutions to environmental or social problems” while accruing new capital in impact is not mentioned in SFDR.

Timeframes

Some ESG investment professionals have noted the multi-year timeframes the FCA has set for the industry to comply with the proposed requirements – with performance-related disclosure being given a 2025 deadline. This, they said, was too long in light of the urgency needed to tackle climate change.

However, Ermel flagged again the amount of work involved and said the timeframes are “fair”.

“The general greenwashing rules are coming in quite quickly – June 2023 is only seven to eight months away.

“It would be hard to shorten some of these timeframes if we want the industry to do this credibly. But it is important there are no further delays.”

However, she agreed, in general humanity needs to act faster on climate change and this should not be an excuse for the investment industry to hang around.

Additionally, she called on governments to respond and regulate things such as greenhouse gas emissions at the corporate level.

“We need clear guidance for companies from governments on what they need to do, and this will make it easier for stewardship to be stronger, and for new investments to flow into that impact category,” Ermel said.

The FCA consultation is open until 25 January 2023. It is aiming to finalise its proposals by mid-2023.