2021 marked a decisive turning point for Europe in terms of tackling the burning issue of climate change.

Last July, the EU adopted a comprehensive and legally binding climate action plan that aims at accelerating the continent’s energy transition and reaching net zero carbon emissions by 2050. This new regulatory framework has put in the limelight the importance of climate-related considerations for European investors, as did COP26 last month in Glasgow.

A range of approaches to climate-themed funds

Climate-aware investors have a burgeoning number of choices to invest in. While our focus here is on climate-aware funds – those that specifically focus on climate risks and opportunities – keep in mind that virtually all diversified sustainable funds are also climate -aware, but they consider a broader range of material ESG issues and impact metrics in addition to those related to climate change.

Climate-aware funds span a range of approaches that can be organized into five types:

- Low-carbon are funds seeking to invest in companies with reduced carbon intensity and/or to construct their portfolios to have a lower carbon footprint relative to a benchmark index.

- Climate-conscious funds which select or tilt their portfolios toward companies that consider climate change in their business strategy and therefore are better firms for the transition to a low-carbon economy.

- Climate-solutions funds specifically target companies providing or benefiting from products and services that contribute to the low-carbon transition.

- Clean-energy/tech funds are more focused than climate-solutions funds, investing in firms that specifically contribute to or facilitate the clean energy transition. Most of these companies are in the utilities, industrials, and tech sectors.

- Green bond funds invest in debt instruments that finance projects facilitating the transition to a green economy.

Europe dominates the climate fund landscape

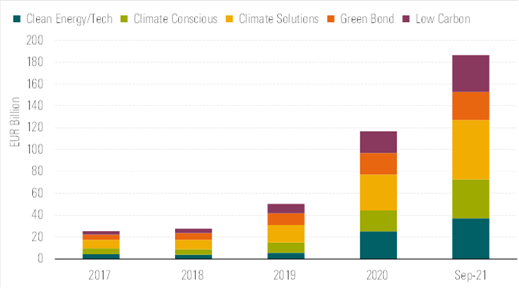

Europe is by far the largest and most diverse universe, with 426 climate-aware strategies, totaling €186bn in assets, as of September 2021. This is fourfold the amount of money invested in such funds two years ago.

Figure 1: Asset growth in climate aware funds

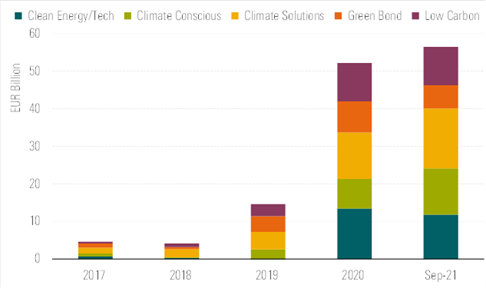

Climate funds have been among the best-selling ESG funds in Europe in 2021: they garnered shy of €56.5bn from January through September. Looking to benefit from green opportunities while mitigating risk, investors mostly flocked into climate-conscious and climate-solutions funds.

Figure 2: Climate aware fund flows

All types of climate-aware funds gained assets, but the one that grew the most is climate-solutions products, which now account for 30% of all assets in climate funds. The smallest category is green-bonds funds, accounting for less than 14% of total climate fund assets, partly due to the limited -albeit growing- supply of green bonds.

With so many climate-aware fund options, understanding the range of strategies is an important first step in positioning portfolios to align with net-zero goals.

Here, we look at three different climate funds awarded the ESG Commitment Level of Advanced or Leader.

Impax Environmental Markets

This climate solutions fund, which earns a Morningstar ESG Commitment Level of Leader, benefits from a well-resourced and highly experienced team. The fund invests in growth companies that derive at least 50% of their business from environmental markets (such as alternative energy, waste and resource recovery or sustainable food, agriculture and forestry) while having a strong valuation discipline. The team integrates a wide range of ESG information into its solid 10-step company research process. The strategy further distinguishes itself by its strong active ownership practices. There is nevertheless some room for improvement as no fund-level ESG metrics nor active ownership reporting are yet publicly available for this strategy.

iShares Green Bond Index Fund

This fund undertakes a comprehensive screening and monitoring of green bonds, while providing a broad coverage to the global green bond market, including both self-labeled and unlabeled bonds. The strategy earns an ESG Commitment Level of Advanced.

IShares Green Bond is a low-cost option for investors seeking exposure to the growing market of green bonds. The fund tracks an index that provides broad diversification across the current sectors and regions that make up the green bond market. Green bonds are evaluated based on criteria that reflect themes articulated in the Green Bond Principles. Failure to report on use of proceeds triggers permanent removal from the index, which incentivizes issuers to comply with annual reporting requirements.

Xtrackers MSCI USA ESG ETF

This low carbon fund boasts one of the cleanest carbon-emissions credentials in its category, making it worthy of a Morningstar ESG Commitment Level of Advanced. As an initial hurdle, the strategy excludes companies with revenue stemming from controversial subsectors such as controversial weapons, tobacco, gambling, nuclear power, and thermal coal. Additionally, the strategy strives to invest in companies with the lowest exposure to carbon emissions. This is done by applying two independent screens to the MSCI USA benchmark. The first is a carbon emissions screen that excludes the highest 20% of CO2 emitters. The second is a screen designed to select companies with low exposure to fossil-fuel reserves. The comprehensive screening and its focus on the minimization of carbon emissions typically results in high active share relative to the parent benchmark.