The $54trn investor-led initiative Climate Action 100+ has released its first benchmark analysing the world’s largest greenhouse gas emitting companies, finding none to have fully disclosed how their 2050 net-zero goals will be achieved.

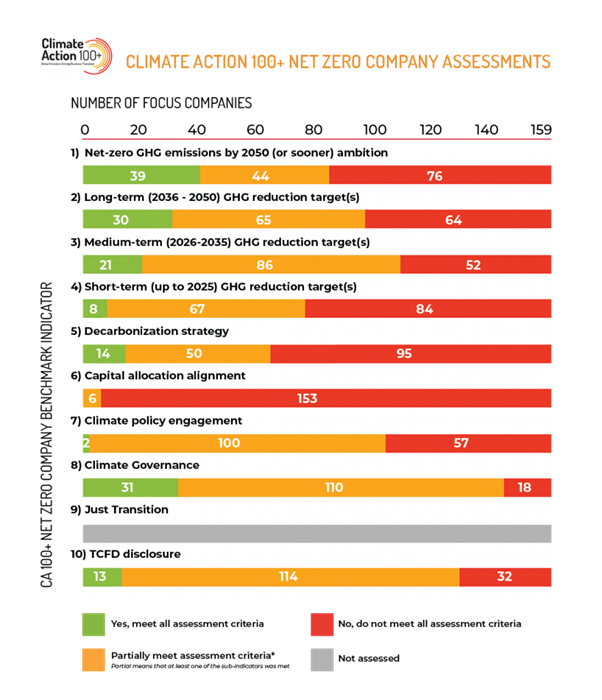

The Climate Action 100+ Net-Zero Company Benchmark evaluated 159 companies across nine key indicators, including short, medium and long-term emissions reduction targets, decarbonisation strategy and climate governance.

It found no company it assessed performed at a high level across all indicators, and no company has fully disclosed how it will achieve its goals to become net zero by 2050 or sooner.

This is despite more than half having made these commitments. Although 83 of the companies (52%) have announced 2050 net-zero ambitions, 44 of these do not cover the full scope of the companies’ most material emissions.

The initiative also found just six companies explicitly commit to aligning their future capital expenditures with their long-term emissions reduction targets, and none of these companies has committed to aligning future capital expenditure with the goal of limiting temperature rise to 1.5 degrees Celsius.

Similarly, the 1.5 degrees Celsius target is not being used enough in future scenario planning at companies. Despite 72% committing to align disclosures with the Task Force for Climate-related Financial Disclosures recommendations, only 10% use climate-scenario planning that includes that scenario.

It said corporate boards and executive management teams need to step up governance when it comes to climate change, particularly by linking climate targets to executive pay, which only a third have done.

Engagement tool

As well as setting out what a good ‘net-zero-aligned’ business strategy entails, Climate Action 100+ hopes the benchmark will be a useful tool in investors’ engagement activities with companies.

Andrew Gray, director, ESG and stewardship at AustralianSuper and Climate Action 100+ steering committee member, said: “As the first cohesive investor–led framework for the world’s top carbon emitters, this is an ambitious initiative that will enable climate change engagement to go to the next level. The ability to measure through benchmarking means investors can set a base to track the progress of companies in relation to their management of climate change investment risks and opportunities.”

The benchmark has been created in collaboration with many research and data organisations, including the Transition Pathway Initiative, 2° Investing Initiative, Carbon Tracker Initiative, InfluenceMap, Grantham Research Institute on Climate Change and the Environment at the London School of Economics and FTSE Russell.

Maarten Vleeschhouwer, head of PACTA, 2 Degrees Investing Initiative, called it a “wake-up call” to investors and companies, and said it shows the vast majority of companies in these carbon-critical sectors are still not aligned with the Paris Agreement goals.”

It has been led by the Climate Action 100+ steering committee, and the collaboration of investor signatories and experts from AIGCC, Ceres, Institutional Investors Group on Climate Change (IIGCC), IGCC, and Principles for Responsible Investment (PRI).

Stephanie Pfeifer, CEO at IGCC, called it “exacting” but “required”, with PRI CEO Fiona Reynolds adding it provides the world’s largest emitters with a “common and consistent goal to aim for”.

Climate Action 100+ said the next benchmark will be published in 2022. Adam Matthews, chair, Transition Pathway Initiative and chief responsible investment officer, Church of England Pensions Board said: “This benchmark captures where we are at the beginning of the Transition Decade, and it shows the distance we still need to travel.”