Investment managers are showing more commitment to responsible investment, but areas such as addressing climate change and stewardship practices need improvement, an LCP survey has found.

Every two years, LCP undertakes a survey of investment managers’ responsible investment practices to supplement our in-depth discussions with managers about their responsible investment approaches for specific products. We have just published the analysis of our sixth survey, Raising the Bar, conducted in the second half of last year. We asked questions spanning ESG integration, climate change and stewardship, and received responses from nearly 150 managers.

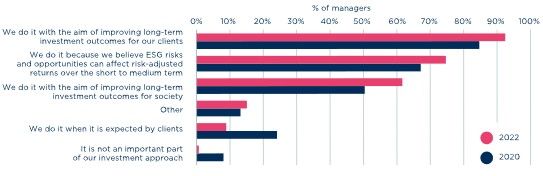

Almost all managers we surveyed are now PRI signatories – 96%, up from 66% six years ago – and only 1% said ESG integration is not an important part of their investment approach, down from 8% two years ago. Their reasons for embracing ESG have become more financially oriented (see chart). Some 92% aim to improve long-term outcomes for their clients and 75% believe ESG factors can affect risk-adjusted returns over the short to medium term, whereas just 9% say they only integrate ESG considerations when this is expected by clients, down from 24% two years ago.

Which of the following statements describe your approach to ESG integration?

We saw an encouraging increase in the proportion of responsible investment specialists, which we defined as investment professionals with a relevant qualification or whose role is more than 50% ESG and/or stewardship. These specialists comprise more than 5% of investment professionals at 47% of managers, up from 27% two years ago and 15% four years ago. An increasing number of investment professionals have ESG and/or stewardship in their job description and receive mandatory responsible investment training.

However, disappointingly, there are still 33% of managers with no-one at board level responsible for responsible investing oversight and responsible investment training is only mandatory for 23% of boards.

Climate practices

The weakest area of managers’ responses was climate change. Significant improvements are needed to ensure the risks and opportunities to our clients’ investments are being addressed properly, and the investment industry is pulling its weight in the race to net zero (which is the only way of avoiding the major physical risks that investors and society otherwise face). Only 44% of respondents have signed up to the Net Zero Asset Managers initiative so far and their work to meet this commitment is still at an early stage. However, we are encouraged by the momentum that is building in this area and are optimistic that we will see rapid improvements.

Unsurprisingly, our survey showed big gaps in climate data availability and usage. We asked managers whether they are using climate-related metrics across the majority of their strategies. For transition risk metrics, only around 60% said yes for listed equity and non-government credit strategies. The proportions were even lower for other asset classes and physical risk metrics.

This is worrying given the widespread relevance of climate risks, although managers are working hard to improve data availability and reporting capabilities. They are projecting significant increases in the proportion of strategies for which they’ll be able to report basic climate metrics to clients by the end of 2022.

Falling short on stewardship

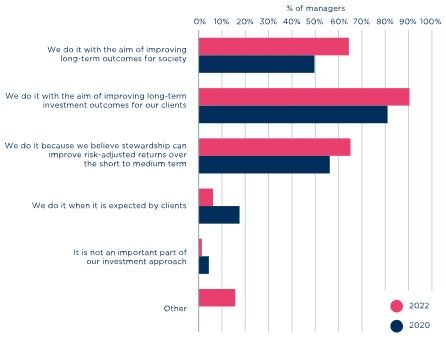

Nine in 10 managers surveyed use stewardship to improve long-term investment outcomes for their clients and only 1% said stewardship wasn’t an important part of their investment approach (see chart). Some 95% of respondents said they collaborate with other investors and 90% undertake engagement with policymakers or regulators.

Which of the following statements describe your approach to stewardship?

These are strong headline results, although the picture is mixed once you drill into the details. For example, 42% of managers do not have a formal escalation policy and less than half set objectives for all engagements they undertake. Only 38% are currently signatories to the UK Stewardship Code 2020.

See also: – 60% of asset managers successfully sign UK Stewardship Code

Most listed equity managers met our basic voting expectations. Similarly to our last two surveys, on average they exercised 97% of votes and voted against management, or abstained, at least once at 35% of AGMs in the year to 30 June 2021. Disappointingly, 16% said they rely completely or a lot on proxy voting advisers’ standard recommendations.

There is still much room for improvement in responsible investment practices across the industry, with wide variations in standards between managers. Asset owners therefore cannot assume that their managers do responsible investing well and must probe the information they receive. Even where their manager compares favourably with peers, they should investigate the actual practices adopted for their mandates and encourage continued improvements in key areas such as climate change and stewardship. In this way, they will help raise the bar on responsible investment and drive better outcomes for their ultimate beneficiaries.