The Church of England has committed to divesting from all fossil fuel companies by 2023 but said that calls for it to do so earlier, by 2020, would leave its “strategy and influence in tatters.”

The Church is one of the most influential institutional investors in the UK, managing billions of assets, including the Church Commissioners’ £8.3 billion investment fund.

On Sunday, the General Synod released a media statement stating its preference for ongoing engagement with fossil fuel companies “rather than prematurely disinvesting.” The comment was in response to some NGOs that had called for the Church to bring forward its divestment deadline to 2020.

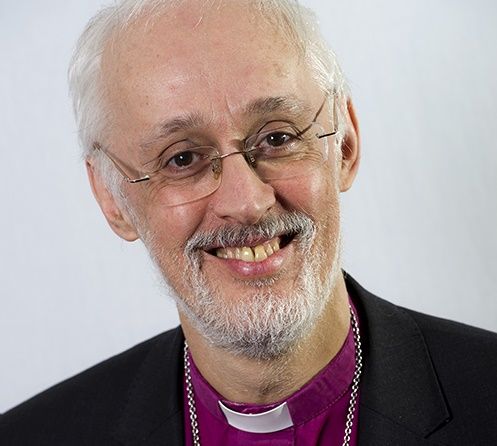

In the statement, David Walker, bishop of Manchester and deputy chairperson of the Church Commissioners, said: “Unilateral, wholescale disinvestment from fossil fuel producers in 2020, or beginning in 2020 based on assessments in 2020, would leave our strategy, and influence, in tatters.

“It would not spur companies on to change further and faster. It would do the exact opposite; it would take the pressure off them. Now is not the moment to do that.”

On Monday, the BBC reported that the Church Commissioners had more than £123 million invested in oil and gas firms at the end of last year.

In an interview with ESG Clarity, Jeanne Martin, senior campaigns officer at Share Action, said momentum is building on fossil fuel divestment, with investors increasingly demanding that companies outline clear transition plans away from processes and products which contribute to climate change.

She said: “Shareholder voting is part of engagement, but I would never expect an investor to vote on something without having first raised that with a company. Shareholder voting is most useful when engagement hasn’t worked.”

Martin added that investor engagement has been building beyond oil and gas companies and is now extending to car companies on emissions, with demands around transition planning growing each year.

In a statement to ESG Clarity, Catherine Howarth, chief executive of ShareAction, acknowledged the influence that the Church of England now has in the oil and gas sector, saying it had become recognised as being “tough-minded and pro-active” in its approach to engagement.

She explained: “Influence is best achieved by making effective use of shareholder rights, and we look forward to the Church of England continuing to make an impact on corporate boards in the oil and gas sector and on fellow shareholders in those companies.”