CFA Institute has launched global voluntary standards for full disclosure of investment products’ ESG approaches.

CFA Institute said the objectives of the Global ESG Disclosure Standards for Investment Products include addressing greenwashing and making it easier for investors to understand and compare ESG products.

For investment managers, the standards are designed to reduce the firm’s legal and compliance risk, facilitate sales and distribution and increase efficiency responding to requests for proposals and due diligence questionnaires. Signing up to the standards could also boost an investment managers’ brand, CFA Institute said.

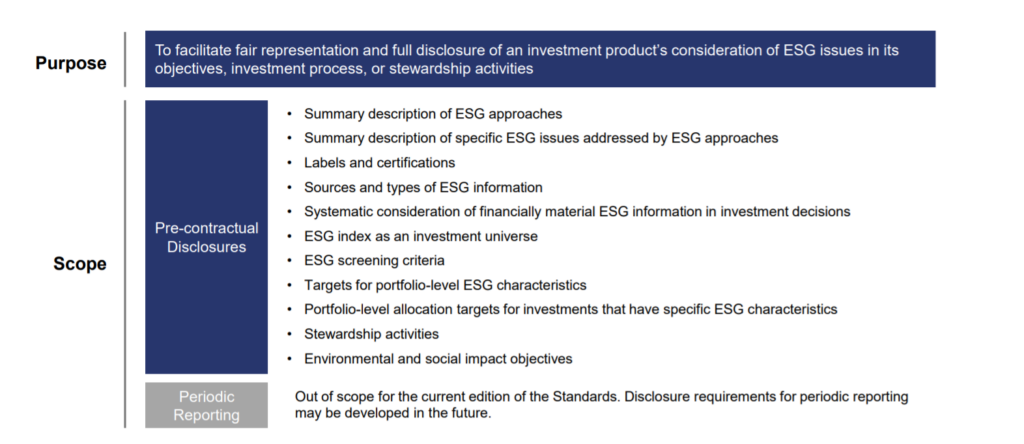

The parameters of the standards suggest asset managers should publish products’ objectives, investment process, stewardship activities and disclosures. The standards do not cover periodic reporting, corporate ESG reporting or firm-level ESG disclosures – apart from stewardship activities. They also do not cover naming, labelling, or rating of investment products.

The global standards, which can be applied on a product-by-product basis, cover all ESG approaches, investment vehicles, asset classes and markets.

Mitigating greenwash

CFA Institute has published the standards after industry-wide consultation which Margaret Franklin (pictured), CFA Institute president and CEO, said was to ensure the standards have impact and meaning: “We’re proud to release the first edition of the standards after a multi-stage development process to ensure the result is additive, has impact, and is meaningful to the industry.

“The complexities of the ESG investing landscape remain vast. We must identify ways to mitigate greenwashing and preserve the integrity of the information being shared about ESG investment products to make them more understandable and comparable to the end investor. The release of the standards marks one step in the broader efforts to make that a reality – and we believe an important one.”

Meeting market needs

CFA Institute managing director for research, advocacy, and standards, Paul Andrews, commented: “Although there are differing regulations in global markets to address transparency for investors on ESG matters, it is critically important that a harmonised, global approach exists to enable investor protection.

“Furthermore, such regulation does not always comprehensively cover all market participants. The standards fill these market needs on a global scale, facilitating important disclosures that will drive greater communication between the buyers of investment products and an industry marketing increasing numbers of funds and strategies that offer an ESG-centric approach.”

Over the next six months, CFA Institute will publish materials such as independent assurance procedures, a handbook that explains the provisions of the standards and an optional template to standardize the format of investment product ESG disclosures.