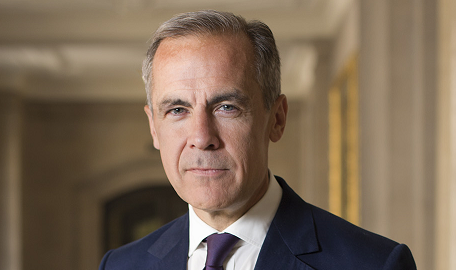

Mark Carney, UN special envoy on climate action and finance, has urged policymakers to be clear on ESG company reporting as there is private capital “lining up to put money to work”, but is held back by the lack of clear reporting.

Speaking at Credit Suisse’s Sustainability Week, the former governor of the Bank of Canada and head of the Bank of England noted G7 countries had recently stepped up at the Cornwall summit by committing to mandatory climate reporting, under the Taskforce for Climate-related Financial Disclosure (TCFD), but noted the “impatience” investors have in wanting to invest in climate change solutions.

“The message to the G7 and policymakers is that the private sector is lining up to put money to work – to amplify that we need to have credible and clear climate policies. That’s what drives investments. This will create that virtuous circle between the finance sector and the real economy,” Carney said.

See also: – Carney urges corporates to make net zero the norm by COP26

He ran through the risks and opportunities for investors in terms of climate investing and noted the plethora of the latter available as he highlighted renewable energy infrastructure investment is doubling every year and will do so for 30 years.

“There is an enormous commercial opportunity – those investments will make money, I am pretty confident.”

He also said this will boost competition: “If something is going to cost $2trn more for 30 years, and someone comes up with a way to make it cost less, even a few basis points, will make a difference when you are dealing with $2trn.”

But on company climate information he added: “I tend to find my conversations with investors are filled with excitement and a bit of impatience on their part on the information they need to make sure they are making the right judgment on where to put their money.”

Carney said: “Information and comparable data is the lifeblood of these companies. We need comparable and consistent disclosure. And we need more progress on the plumbing of the financial system and commitments from multi-lateral institutions that lever private capital.”

G7 and demand

Discussing the prominence of the climate crisis at the G7 summit, Carney said the topic was “in the leaders’ room, it was in the run-up and beyond, it really was front and centre” as he also pointed to the rise in commitments to net-zero targets.

He said some 130 governments have pledged net-zero emissions in various forms and at the start of Covid-19, 30% of emissions were covered by these commitments – this has now increased to 73%.

“We are also seeing these commitments cascading down from government into companies and the financial sector,” he commented.

The interest in climate change and ESG investing had started to rise before Covid-19 hit, but the pandemic exacerbated demand.

Carney explained: “15 months ago, if I had been asked, ‘would ESG advance or reverse’, my prediction would have been a classic central banker answer of 50/50. What we saw with the global financial crisis is it set things back in terms of climate, as the focus was immediately on the economy.

“But Covid has accelerated the focus on sustainable investing and brought it from the periphery to the mainstream. It is now in the top three, if not the top, in terms of strategic issues for financial institutions.

“The lessons of Covid have been the importance of resilience and that we should listen to science before the calamity and not after.”

See also: – Is Mark Carney ‘Eco-warrior of the Year’?

Referring back his points on investing in climate change solutions, Carney said in order to make progress we need to put this money to work: “We are not going to shrink our way to net zero, we need to invest our way to net zero.

“There is a huge amount of momentum underway on which to build upon.”

He added people should be asking themselves what their companies are doing, and “am I in a financial institution that fails while the world succeeds?”.

Carney also reiterated: “It’s important for us to get across the scale of investment – it is so large that we absolutely need mainstream private capital to get anywhere close to getting the building blocks there.”