BlackRock is planning to expand its proxy voting choice program to some individual fund shareholders, announcing the move a day after Vanguard said it was doing something similar.

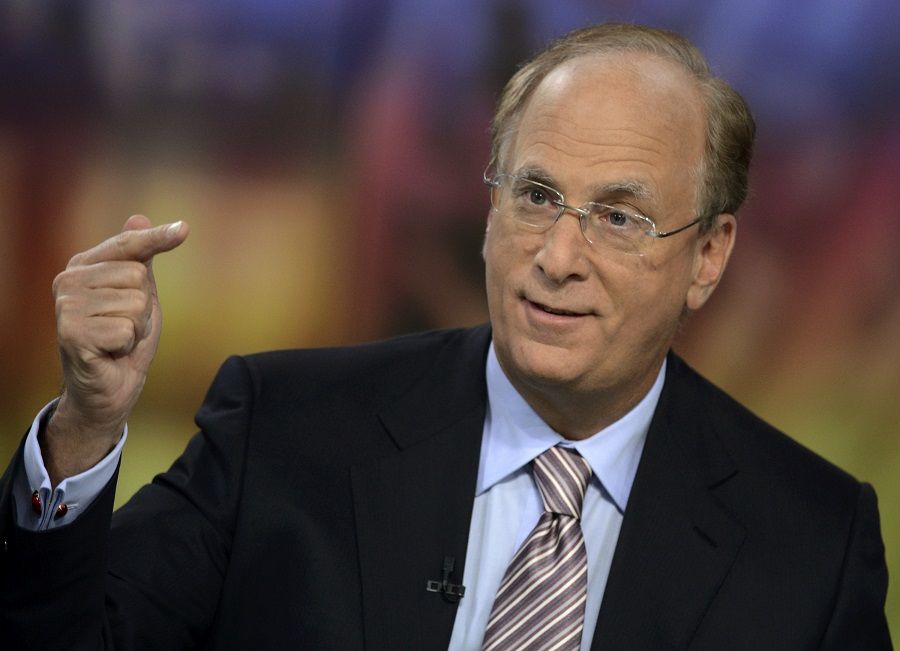

Initially, the program will be available to UK investors, but it could eventually expand to all fund shareholders, CEO Larry Fink said in a letter to client and corporate CEOs.

A year ago, BlackRock launched its voting choice option for institutional investors, allowing big clients like pension funds, endowments and insurance companies to decide how their shares are voted. Since then, institutions holding a quarter of the assets that are eligible for that program, representing $295bn, have controlled how their shares are voted, the company said.

Beyond institutional asset owners, the only other eligible clients have been ultra-high-net-worth individuals in separately managed accounts through Aperio, which BlackRock acquired in early 2021.

However, the company is working to let some UK mutual fund shareholders vote how they please.

“We are working with a digital investor communications platform in the UK to enable investors in select mutual funds to exercise choice in how their portion of eligible shareholder votes are cast,” Fink said in today’s letter. “This is an industry first to translate individual investor views into voting instructions.”

That could eventually extend to US fund shareholders.

“My hope is that in the future, every investor — ultimately including individual investors — has access to voting choice, if they want it,” Fink wrote.

Too many questions

Engagement is particularly important for index funds, he said, as those vehicles hold stocks for an average of 20 years, compared with the 18 months in actively managed funds.

However, the firm does not expect individual investors “to wade through thousands of proxy questions every year,” and it will almost certainly keep voting shares on their behalf in a way that it sees as maximizing long-term returns.

In addition, it would currently be too expensive to extend proxy voting choices to each individual fund investor without further technological advances that would reduce costs, Fink said.

In the future, “all investors should be able to pick from a range of voting policies to reflect their preferences and … it should be as easy to do so as it is to buy a mutual fund or ETF on your mobile phone today,” Fink said.

Such a change would require cooperation among policymakers, regulators, fund boards and asset managers, he noted.

Countering anti-ESG trend

Fink also tipped his hat to a peer company, presumably Vanguard, for its announcement that it would let some index fund shareholders weigh in on proxy voting issues.

Giving individual investors some autonomy over proxy voting could help deflate the attacks over ESG that BlackRock and other big asset managers have recently faced from some conservative politicians. However, those campaigns have ramped up even as BlackRock has clarified its role as a major investor in the oil and gas business and stated that its primary interest is maximizing returns.