Big investors in meat and dairy companies lack policies and commitments to drive down methane emissions despite global pledges to do so, a Planet Tracker study has found.

Hot Money, a report from the financial think tank and the Changing Markets Foundation, analyzed 20 investors and 20 banks currently financing the methane-generating activities of 15 leading global meat and dairy companies, identified in terms of equity ownership, bond ownership and bank funding, and corroborated by the World Benchmarking Alliance.

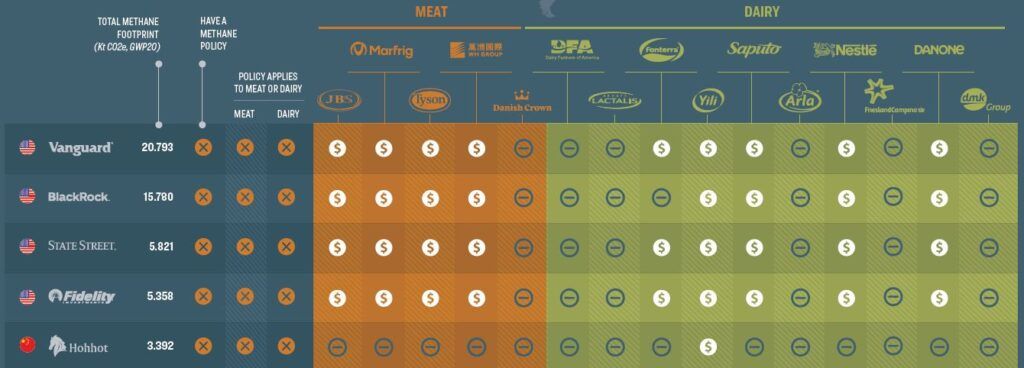

Combined, the 40 institutions were responsible for funding a methane footprint that could exceed 500 Mt CO2e – nearly as big as the CO2 emissions of Saudi Arabia – with 68 Mt CO2e of agri-methane specifically coming from the 20 asset managers. Of these asset managers, Vanguard financed the most methane emissions, followed by BlackRock and State Street.

Despite all but one (China) of the seven countries in which the 20 meat and dairy investors are headquartered having signed the Global Methane Pledge when it was announced at COP26 in Glasgow, not one asset management firm in the report has a policy that specifically covers methane emissions from livestock.

The countries that have signed the pledge agreed to take voluntary actions to contribute to a collective effort to reduce global methane emissions by at least 30% from 2020 levels by 2030, which could eliminate more than 0.2ºC warming by 2050. In November 2022, at COP27, the US and EU announced the launch of the ‘GMP Food and Agriculture Pathway’ which includes a focus on reducing agri-methane emissions supported by a variety of new initiatives.

“At the moment there is little sign that financial institutions are following the lead set by their host countries,” the report said.

Top five investors in the 15 largest meat and dairy companies

Nusa Urbancic, campaigns director at the Changing Markets Foundation, said it was “disappointing” to see the finance sector “missing in action” when it comes to methane emissions.

“They must join the methane momentum sparked by the Global Methane Pledge and demand urgent corporate action to cut methane, starting at this year’s upcoming AGM season,” she said.

As a climate pollutant methane is 80 times worse than CO2 over a 20-year period, with just a handful of meat and dairy companies responsible for one in every 10 tons of methane produced by livestock.

Call to action

Planet Tracker and the Changing Markets Foundation are therefore calling on financial institutions to set clear methane policies for the companies they invest in, and create investment policies integrated into their net-zero policies that are linked to quantitative, time-framed and science-based methane reduction targets.

Because data and disclosure are a particular issue in this area (the report said livestock corporations rarely, if ever, report their methane emissions and those that do are limited to Scope 1 emissions), Planet Tracker and the Changing Markets Foundation are also asking investors to demand energy, meat and dairy companies publish quantified, independently verified, full methane emission disclosure (Scope 1, 2 and 3) by product line and geography, on a timely basis; require the food production companies they fund to publish production data, by product line and geography, in their annual reports; and report annually on their progress with respect to limiting methane emissions, including those from agriculture.

See also: – Asset managers target animal agriculture firms in engagement campaign

“This report highlights the significant role that financial institutions have to play in limiting agricultural methane emissions,” said Peter Elwin, director of fixed income and head of food and land use program at Planet Tracker.

“Cutting methane emissions gives financial institutions the greatest bang for their buck enabling them to rapidly reduce the greenhouse has footprints they fund. More importantly, tackling methane emissions now will have an amplified positive impact in slowing global heating before 2050.”